In today’s competitive business landscape, companies face numerous challenges when it comes to managing their human resources. From recruiting top talent to navigating complex employment laws, the HR function can be a time-consuming and costly affair. That’s where Professional Employer Organizations (PEOs) come in. PEOs offer businesses an innovative solution known as co-employment, which can help drive growth, success, and save both time and money.

In this article, we will demystify PEO co-employment and provide you with everything you need to know to make an informed decision for your business.

What is PEO Co-Employment?

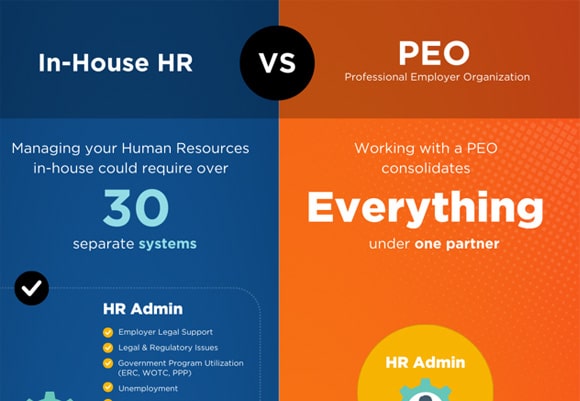

PEO co-employment is a strategic partnership between a PEO and a client company. In this arrangement, the PEO becomes the employer of record for the client’s employees, sharing certain employer responsibilities and liabilities. This means that the PEO takes on key HR functions such as payroll processing, benefits administration, risk management, and compliance, while the client company retains control over day-to-day operations and management of their employees.

Falsehoods Surrounding Co-Employment

Co-employment, also known as employee leasing or shared employment, is an arrangement in which a PEO enters into a contractual relationship with a client company to manage certain human resources tasks. Under co-employment, the PEO becomes the employer of record for tax and insurance purposes, while the client company retains control over day-to-day business operations and retains responsibility for the overall direction and management of their employees.

Despite the numerous benefits that co-employment can offer, there are some common falsehoods and misconceptions that surround this arrangement. Let’s debunk some of the most common falsehoods about PEO co-employment:

Falsehood 1: Loss of Control

One of the biggest misconceptions about co-employment is that the client company will lose control over its workforce. In reality, the client company retains full control over hiring, firing, and managing its employees on a day-to-day basis. The PEO’s role is to handle administrative tasks such as payroll processing, benefits administration, and compliance with employment laws. By offloading these time-consuming tasks to the PEO, the client company can focus on strategic initiatives and core business functions.

Falsehood 2: Legal Liability

Another falsehood surrounding co-employment is that the client company will transfer all legal liability to the PEO. In reality, both the PEO and the client company have shared liability in certain areas. The PEO takes on responsibility for employment taxes, workers’ compensation insurance, and other HR-related compliance matters.

However, the client company still maintains liability for its own actions, such as hiring decisions, workplace safety, and compliance with laws and regulations. It’s important for both parties to have clear expectations and a solid understanding of their respective responsibilities to ensure a successful co-employment relationship.

Falsehood 3: Loss of Employee Benefits

Some businesses may be concerned that co-employment will result in a loss of employee benefits. However, this is not the case. In fact, partnering with a PEO can often provide access to a broader range of employee benefits and cost-saving opportunities. PEOs often have the ability to offer competitive benefits packages due to their larger pool of employees, which can include health insurance, retirement plans, and other perks.

By leveraging the PEO’s buying power, businesses can provide their employees with comprehensive benefits that may not have been affordable otherwise.