HR Resources

Downloadable Resources

HR Articles

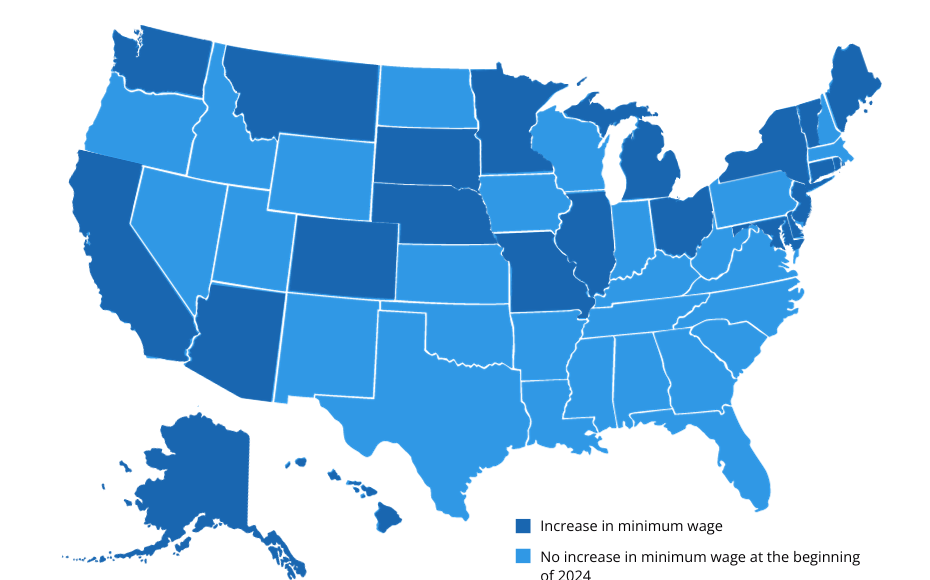

As we transition into 2024, it is important for both employers and employees to understand and assess changing wage and labor laws and how it may affect your organization. On…

Workers’ compensation is an essential aspect of managing a business, ensuring the health and safety of your employees while protecting your company from potential liability. However, administering workers’ compensation can…

Running a business involves juggling a multitude of responsibilities, including managing human resources. As a business owner, you may often find yourself overwhelmed with the complexities of HR tasks, from…

PEO Benefits Unveiled: Top 9 Insights The Ultimate Guide on PEOs Published September 25, 2023 Table of Contents What is a PEO? What Does a PEO Do? How Does a…

The Americans with Disabilities Act defends the rights of people with disabilities in the context of employment. Title I of the ADA pertains to employers with at least 15 employees.…

A Professional Employer Organization (PEO) is a company that provides comprehensive HR solutions to businesses. They handle various aspects of HR, such as payroll, benefits administration, employee onboarding, and compliance…

A PEO, or Professional Employer Organization, is a company that provides comprehensive HR solutions to businesses. These organizations partner with businesses to handle various HR tasks, such as payroll processing,…

As a business owner, you understand the importance of having effective HR solutions in place to support your employees and drive growth. However, managing HR tasks in-house can be a…

Are you a business owner or manager looking to streamline your HR administration, enhance productivity, and reduce costs? Look no further than Professional Employer Organization (PEO) HRIS software. This powerful…