As we transition into 2024, it is important for both employers and employees to understand and assess changing wage and labor laws and how it may affect your organization.

On January 1st, 2024, Michigan’s minimum wage increased from $10.10 to $10.33 per hour. This increase is part of Michigan’s Improved Workforce Opportunity Wage Act of 2018 to raise the minimum wage by $0.46 cents between 2023 and 2025.

In addition to the minimum wage increase, the tipped employee rate for hourly pay increased to $3.93, and the 85% of the minimum wage rate for minors aged 16 and 17 increased to $8.78 per hour. The training wage of $4.25 per hour for newly hired employees ages 16 to 19 for their first 90 calendar days of employment remains unchanged.

Note that state law excludes from coverage any employment subject to the federal Fair Labor Standards Act unless the State wage rate is higher than the Federal rate. The Federal minimum wage remains at $7.25 per hour for non-tipped employees and $2.13 per hour for tipped employees.

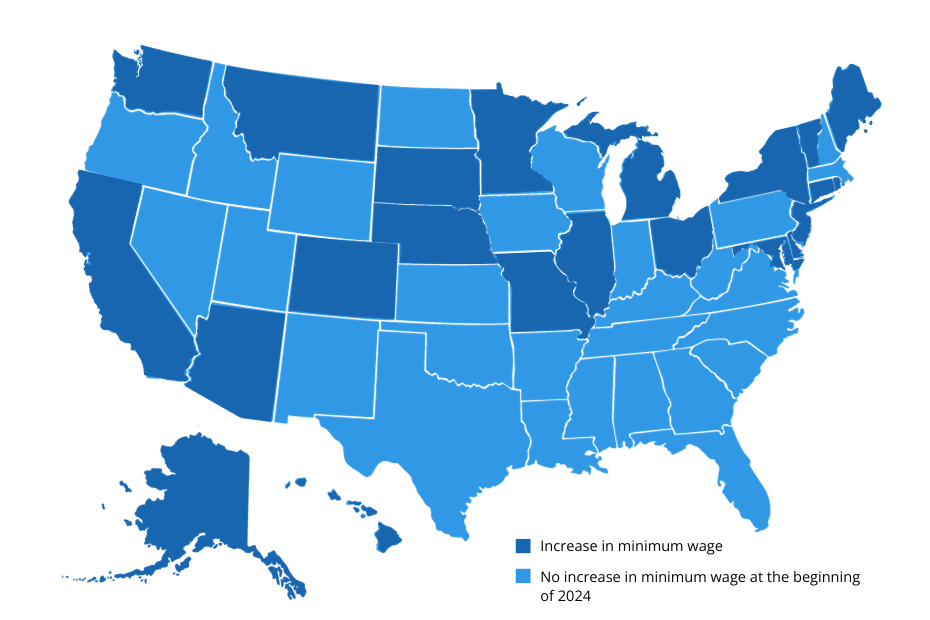

Twenty-two (22) additional states have announced minimum wage increases for 2024. They are listed below:

Alaska ($11.73)

Arizona ($14.35)

California ($16.00 – Wage by City in California)

Colorado ($14.42)

Connecticut ($15.69)

Delaware ($13.25)

Hawaii ($14.00)

Illinois ($14.00)

Maine ($14.15)

Maryland ($15.00)

Minnesota ($10.85 – Annual Revenue of at least $500,000); ($8.85 – Annual Revenue Less than $500,000)

Missouri ($12.30)

Montana ($10.30)

Nebraska ($12.00)

New Jersey ($15.13 for employers with six or more employees) ($13.73 for seasonal employers and employees with fewer than six employees)

New York ($16.00 per hour – NYC, Long Island and Westchester County) ($15.00 per hour for the rest of the state)

Ohio ($10.45)

Rhode Island ($14.00)

South Dakota ($11.20)

Vermont ($13.67)

Washington ($16.28)

Download a copy of the minimum wage increases here.

A partnership with BCN Services simplifies payroll management for your business. We use state-of-the-art software to handle everything from calculating employee hours to processing taxes and distributing paychecks. Our team offers W-2 / W-3 / 1099 preparation and distribution, federal and state payroll taxes and filings, time and attendance tracking and much more! Have questions as it relates to the changing state minimum wage laws? Contact us today at 734.412.7679.