A PEO, or Professional Employer Organization, is a company that provides comprehensive HR solutions to businesses. These organizations partner with businesses to handle various HR tasks, such as payroll processing, employee benefits management, risk management, and compliance with employment laws and regulations.

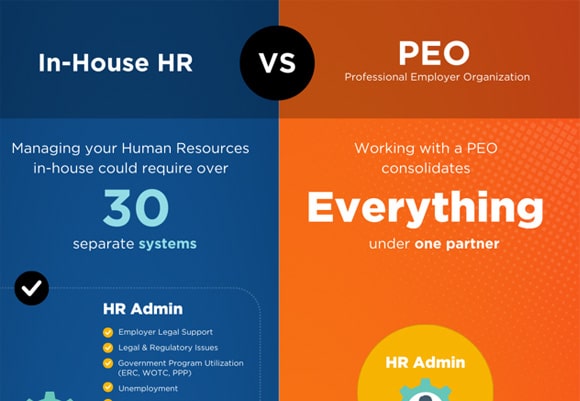

In essence, a PEO acts as an outsourcing partner for HR management. By partnering with a PEO, businesses can offload their HR responsibilities and focus on their core competencies and business growth. The PEO takes care of the administrative burden associated with HR, allowing businesses to save time and resources.

One of the key advantages of working with a PEO is access to a wide range of expertise and resources. PEOs typically have experienced HR professionals who can provide guidance and support in areas such as employee relations, talent acquisition, and performance management. They also have access to technology platforms and software that streamline HR processes, making them more efficient and accurate.

Another significant benefit of partnering with a PEO is the ability to offer competitive employee benefits. PEOs have the ability to pool together the employees of multiple businesses, which allows them to negotiate and secure better rates on benefits such as workers compensation, health insurance, retirement plans, and employee assistance programs. This can be particularly advantageous for small and medium-sized businesses that may not have the bargaining power to obtain favorable rates on their own.

Additionally, PEOs can help businesses navigate the complex landscape of employment laws and regulations. They stay up to date on changes in legislation and ensure that businesses remain compliant,

What does a PEO actually do for your business?

A PEO, or Professional Employer Organization, serves the purpose of providing comprehensive HR solutions to businesses. The main objective of a PEO is to allow companies to outsource their administrative HR functions, enabling them to focus on their core business activities while ensuring compliance with employment laws and regulations.

A PEO can help your business by providing:

HR Expertise

A PEO offers businesses access to a team of HR professionals who are well-versed in various HR disciplines. These experts assist with tasks such as employee onboarding, payroll processing, benefits administration, and compliance with employment regulations.

Cost Savings

By partnering with a PEO, businesses can save money on HR-related costs. PEOs often have the purchasing power to negotiate competitive rates for employee benefits, workers’ compensation insurance, and other HR services. This allows businesses to access cost-effective solutions that may not have been available to them independently.

Risk Mitigation

PEOs help mitigate legal and compliance risks by staying up-to-date with ever-changing employment laws and regulations. They assist businesses in ensuring HR practices are in compliance, mitigating potential fines and penalties associated with non-compliance.

Employee Development

PEOs often provide access to training and development programs for employees, enhancing their skills and productivity. This can contribute to the growth and success of businesses by fostering a knowledgeable and motivated workforce.

Administrative Support

PEOs handle time-consuming administrative tasks, such as payroll processing, tax filing, and benefits administration. This frees up valuable time for businesses to focus on more strategic initiatives, such as driving growth and innovation.