What is a PEO?

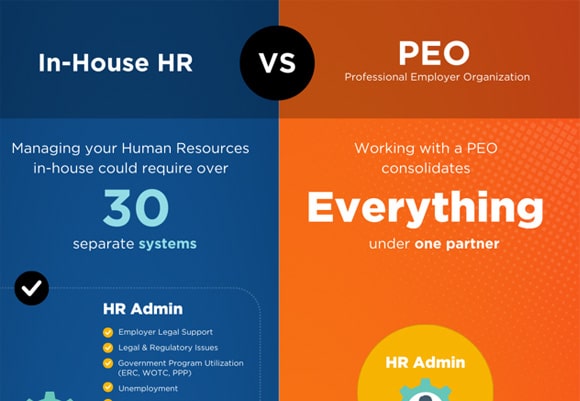

A Professional Employer Organization (PEO) is a business that conducts comprehensive Human Resource (HR) services for another organization (e.g., “the customer”). PEOs process payroll and benefits and maintain regulatory compliance on behalf of their customers.

This saves the PEO customer a great deal in the way of costs and frees them up to spend more time and resources on their immediate operations, and less time and resources on administration.

PEOs aren’t involved in the day-to-day operations or the big-picture decision-making of their customers’ business. That’s part of the reason why PEOs are so valuable for organizations. The PEO customer retains control over their operations, culture, and long-term vision while relinquishing their administrative burden to the PEO.